Auto-assessments by the South African Revenue Service (SARS) are meant to make tax filing easier – SARS uses data from employers, banks, medical schemes, retirement funds and other third parties to automatically calculate your tax return. In fact, SARS auto-assessed about 3.5 million taxpayers in 2024, roughly half of all individual filers. But what if SARS gets it wrong? An automatic assessment might omit income or deductions, resulting in errors in your tax outcome. Below we explain common auto-assessment errors, how to fix them, and what penalties to avoid, so you can set the record straight and avoid paying more tax (or incurring fines) unnecessarily.

Common reasons for an incorrect SARS auto-assessment

Auto-assessments are essentially estimates based on third-party data – and they’re not always accurate. Here are some common reasons your auto-assessed tax could be incorrect:

- Incomplete information: SARS might not have received all your tax certificates or data. For example, if an employer or financial institution submits information late or not at all, that income or deduction won’t reflect in your assessment. This could mean some income is missing or some deductions are missing.

- Outdated or incorrect data: Even if data was submitted, it might not be up-to-date or accurate. Mistakes can happen – your employer, bank, or medical aid might have reported a wrong amount. SARS simply auto-populates what they receive, so any third-party errors flow into your assessment.

- Ignored deductions and expenses: The auto-assessment won’t include certain write-offs or deductible expenses unless they were in the third-party data. Personal deductions like a home office expense, professional wear-and-tear depreciation, donations to charity, travel expenses you paid, or unreimbursed medical expenses do not automatically pull through.

- Other income not reported to SARS: Auto-assessments focus on what's reported to SARS. But if you have income streams SARS isn’t aware of – e.g. rental income, freelance or side-business earnings – those won’t be in the auto-calculation. Relying on the auto-assessment in this case means you’d be under-reporting your income.

An auto-assessment can be convenient if your tax affairs are simple, but don’t assume it’s 100% correct.

It’s up to you to double-check and ensure everything is in order. SARS itself cautions that there “might be some income sources and certainly expenses... of which SARS may not be aware”, meaning the auto result could be wrong.

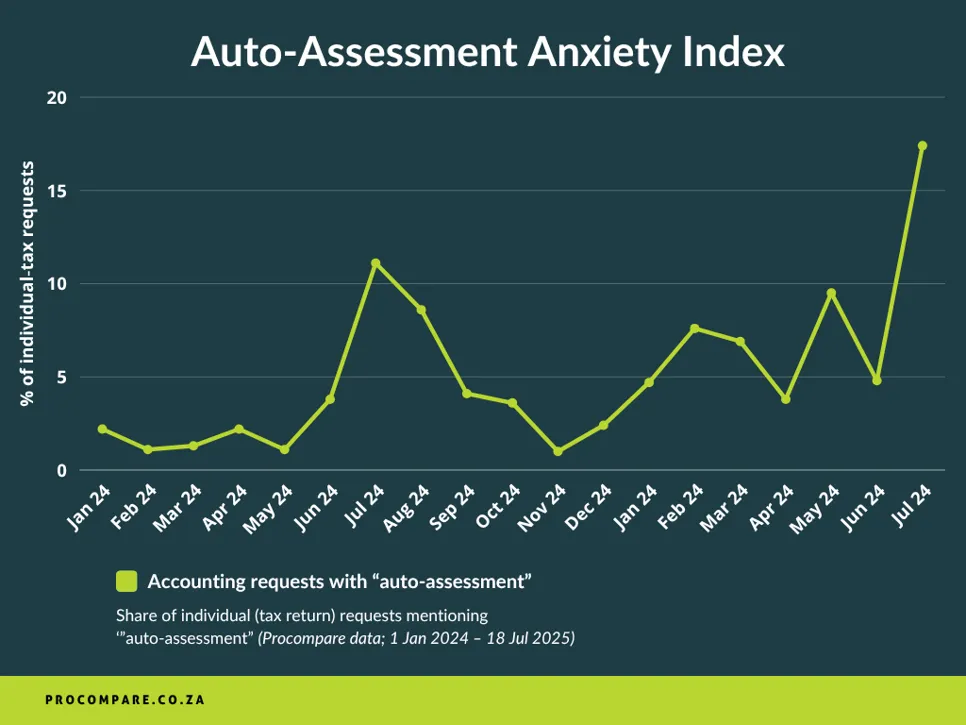

Auto‑Assessment Anxiety Index

Our data reveal a dramatic jump every time SARS opens filing season

- July 2024: 11 % of all individual‑tax requests flagged auto‑assessment issues.

- July 2025 (to 18 July): already 17 m%—and the month isn’t over.

- Smaller—yet still noticeable—aftershocks hit August, February (provisional‑tax crunch) and May (when SARS starts pre‑season data matching).

Each July, the moment SARS SMS notifications land, roughly 1 in 6 taxpayers on our platform look for expert help to fix or dispute an auto‑assessment.Get 6 free quotes from local Tax accountants

What auto-assessment errors tax Pros fix most often

“SARS auto-assessments have definitely kept us on our toes the last few seasons,” says Adriana Taljaard, from AT Accounting & Taxation Solutions. “Most frequent error? Easy — missing medical-aid deductions. It’s like SARS thinks we’re all suddenly super healthy and paying out of pocket!”

To get a clearer picture of the issues taxpayers face, we asked tax accountants who collaborate with Procompare to identify the top mistakes they have to fix. They also shared their average turnaround times and the typical fees they charge for these corrections.

Top 5 auto-assessment errors accountants correct

- Missing medical-aid deductions

- Omitted non-salary income (rental, side-hustle, freelance)

- Duplicate IRP5s

- Unnaccounted travel allowance

- Overlooked retirement-annuity contributions

“For the additional income a P&L must be compiled in order to submit the profits or losses that the additional source of income”, advises Rushaan Toefy, owner of Rushaan Toefy Financial Services from Cape Town. As for the travel allowance, a complete logbook details must be provided in order for SARS to account for the extra tax savings.

How long does it take for accountants to fix auto-assessment errors

| Complexity | Example Task | Business-Day Range |

|---|---|---|

| Simple | Add one missing certificate (donation, RA) | 1 – 2 days |

| Moderate | Compile medical expenses or travel logbook | 2 – 4 days |

| Complex | Rental income or home-office calculation | 3 – 7 days |

Average turnaround for an accountant to fix auto-assesment error is 2 – 5 working days once all documents are in.

What will the accountant charge you for fixing auto-assesment error

| Service Level | Description | Estimated Fee (ZAR) |

|---|---|---|

| Simple Correction | Single missing item with certificate | R 400 – R 1 000 |

| Complex Correction | Rental, home office, capital-gains rewrite | R 1 200 – R 3 300+ |

Average fee for a straightforward correction is about R 800.

“For a clean-cut correction, you’re looking at R 450 – R 950. If it turns into a drama series with supporting documents and disputes, we’ll quote accordingly — popcorn not included,” adds Adriana Taaljard.

Penalty vs. accountant fee

The standard SARS understatement penalty is 25 % of the tax shortfall. For example, if an individual owes an additional R 25 000 in tax, the 25 % penalty would amount to R 6 250, illustrating the sort of mid-range cost a typical auto-assessment correction can carry before interest.

- Typical accountant fee: R 800

- Standard understatement penalty: ~R 6 500

Paying a pro to fix the error is usually eight times cheaper than waiting for SARS to levy the penalty — and that’s before interest starts accruing.Get 6 free quotes from local Tax accountants

How to correct your SARS auto-assessment: a step-by-step guide

If you suspect “Auto-Assessment” = “Auto-Oops” in your case, take action quickly. SARS gives you an opportunity to correct any errors, but you must be proactive. Follow these steps to review and correct your tax return when the auto-assessment seems wrong:

1. Review your auto-assessment data on SARS eFiling

Start by seeing exactly what data SARS used for your assessment. Log in to eFiling and view your third-party data – SARS lets you check the certificates from employers, banks, medical schemes, etc., that were used. Compare these with your own records (IRP5s, IT3(b) interest statements, medical tax certificates, etc.). Identify any missing or incorrect figures right away.

2. Get third-party data corrected at the source

If you find that a third party provided wrong or incomplete info, ask them to correct it and submit the updated data to SARS. You cannot simply edit pre-populated figures yourself – SARS locks those fields to ensure the data matches official records. Once the third-party data is corrected, refresh your return on eFiling to see the updated figures.

3. Edit your return and add missing income or deductions

Next, make sure to include any income or deductions that weren’t in the auto-assessment. You’ll do this by filing an Income Tax Return (ITR12) on eFiling, which allows you to input the additional information. Essentially, you are “editing” the auto-assessment by submitting a full tax return. In your return, include all the missing items, such as rental income, travel costs, or home office expenses. By doing this, you ensure your final assessment will be based on complete and correct information.

4. Submit your corrected tax return by the deadline

Timing is critical. Submit your corrected tax return by the filing deadline applicable to you (for most non-provisional individuals, this is around 20 October each year). If you were auto-assessed at the start of the season, you have until this deadline to file changes. Do not ignore it – if you do nothing by the cut-off, the auto-assessment becomes final.

If you do nothing by the cut-off, the auto-assessment becomes final and is legally treated as if you filed that return as-is.

5. Keep supporting documents for all changes

As you correct your return, make sure you keep evidence for any new information you add. SARS may ask for verification. For instance, if you add a medical expense deduction or declare extra income, have the receipts, logs or statements ready. Typically, you should hold on to documents for at least five years in case of an audit.

6. Confirm the new assessment from SARS

Once you’ve submitted your corrected tax return, SARS will process it and issue a new assessment (ITA34). This will show your updated tax outcome (refund or amount owing). Double-check this notice to ensure it now reflects what you expect. If something still looks off, you may need to follow up or even file a dispute, but in most cases a properly filed return will resolve the discrepancies.

What to do if you've already accepted an incorrect auto-assessment

Many taxpayers mistakenly think that if SARS auto-assessed them and even paid out a refund, nothing more is required. Be careful: if you have additional income or deductions, you still need to file a return to correct the record. An auto-refund isn’t final if your actual tax calculation should be different – don’t assume “SARS paid me, so it must be right.”

What if you unknowingly accepted an incorrect auto-assessment? In that case, the assessment becomes final, but you still have options to fix it – though it requires extra steps:

- Request an Extension or Correction: SARS has mechanisms to request a correction even after an assessment is final. You can submit a Request for Correction (RFC) on eFiling to amend a return if it was filed with errors. SARS allows taxpayers to apply for an extension for up to 3 years from the auto-assessment date, provided you have valid reasons.

- File a Notice of Objection (Dispute): If the deadline has passed and SARS does not allow a simple correction, you may need to go the formal dispute route. This involves filing a Notice of Objection (NOO) to the assessment. This is a more involved legal process and usually is a last resort.

Penalties for an incorrect SARS auto-assessment

Failing to correct an inaccurate tax assessment can have serious consequences. SARS expects you to report all your income and claim only legitimate deductions, even if their auto-calculation missed something. Ignoring an error might feel convenient now, but it can come back to bite you in the form of penalties, interest, or even criminal charges.

Here are the key risks to be aware of:

- Understatement penalties: If you leave income unreported, SARS can later impose an understatement penalty. For major omissions or fraudulent non-disclosure, penalties can be extremely high, up to 200% of the tax that was underpaid.

- Interest on owed tax: If your auto-assessment was too low, SARS will charge interest on the unpaid amount from the original due date until you pay it. By the time SARS catches the error, the interest could add a significant cost.

- Criminal implications: Knowingly leaving your return wrong can be a criminal offense. SARS has stated that providing incorrect information or failing to correct an assessment is considered criminal tax evasion.

- Paying Back Refunds: If the error in your auto-assessment meant you got a refund you weren’t actually entitled to, SARS will demand that money back once the mistake comes to light (with interest).

- Administrative penalties for late filing: If you completely fail to file a return by the deadline, SARS can levy monthly fines until you file. These administrative penalties start at R250 per month and can go up to R16,000 per month for each month your return is outstanding.

An omission that saved you R5,000 in taxes could cost you an extra R5,000–R10,000+ in penalties.

The simple way to avoid this is: file your return (or corrected return) on time, even if you’re nervous it’s wrong – you can always correct it, but not filing at all is a guaranteed penalty. If you do miss the deadline, submit the return as soon as possible to stop further penalties, then handle any corrections through the proper channels.

In summary, ignoring an auto-assessment error can cost you dearly. The tax system is increasingly data-driven and interconnected – over time, SARS will likely catch what was missed. It’s far better to correct mistakes now than to face a nasty surprise later.

Why you should consider professional tax help

Dealing with tax corrections can be intimidating, especially if you’re not familiar with SARS eFiling or the finer details of tax law. The good news is, you don’t have to go it alone. Seeking help from a tax professional (tax practitioner or accountant) can make the process smoother and give you peace of mind that everything is done correctly.

A good tax professional will:

- Identify any and all issues in your auto-assessment.

- Advise you on the best course of action.

- Maximize your legitimate refunds by making sure you claim every deduction or credit you’re entitled to.

- Handle the SARS submission on your behalf if you prefer.

- Communicate with SARS for you in case any queries or verifications arise.

- Ultimately, save you time and potential penalties by getting it right the first time.

Many taxpayers find that the cost of professional assistance is far outweighed by the potential savings and stress relief. Remember, if a tax practitioner helps you uncover an overlooked deduction or prevents a 25% penalty on a missed income, that already might justify their fee. And importantly, you’ll have confidence that you won’t be getting a brown envelope from SARS down the line saying you owe money.

Ensuring your tax return is correct

Don’t let an auto-assessment error slip through the cracks. Review your SARS auto-assessment carefully the moment you receive that SMS or email. If something looks wrong or too good to be true, it probably is. Take action by correcting any mistakes, either on your own or with the help of a professional. By doing so, you’ll ensure you pay only the tax you truly owe (no more, no less) and avoid nasty surprises in the form of penalties or claw-backs later on.

Auto-assessments are a great convenience, but ultimately you are responsible for your tax return’s accuracy.

Stay proactive, stay informed, and you’ll navigate tax season with confidence – even if SARS’ “auto-filing” tried to steer you wrong.