Top 14 Tax consultants Malmesbury, 2026

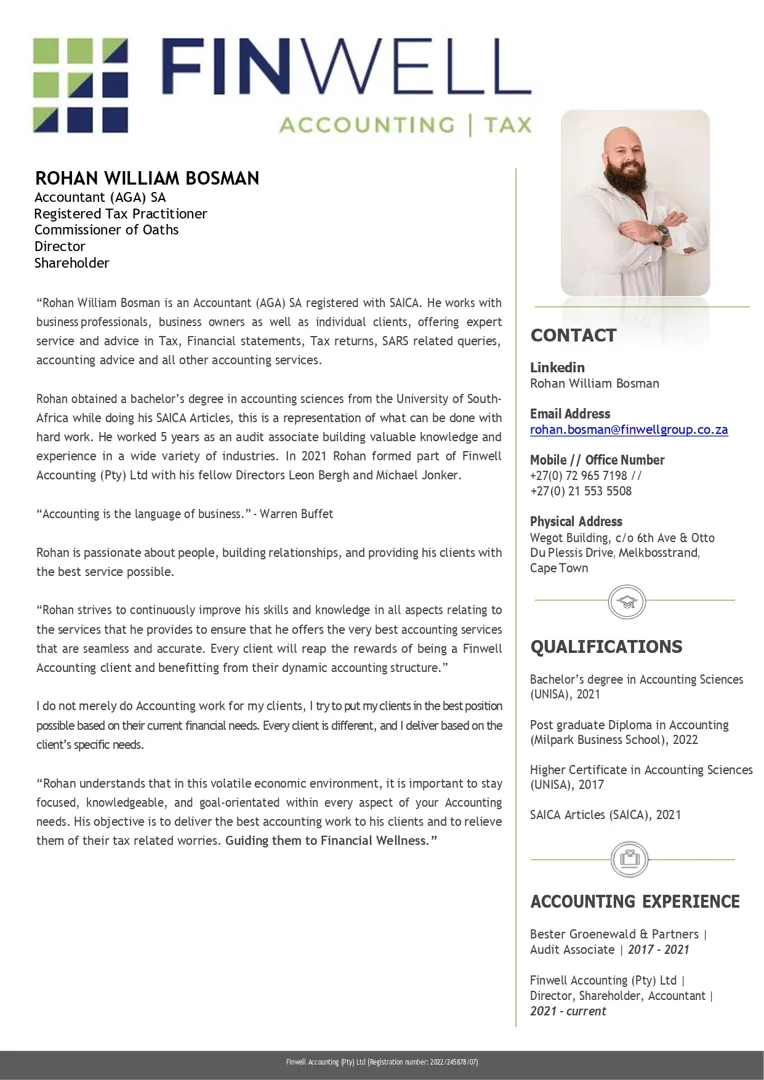

Rohan listen to the problem and gave me advice that allowed me to sort my SARS problem without his services. I referred my son to him who also had (more involved) issues with SARS and Rohan took care of it and charged the expected fee.

Thank you for your review. I am very glad to hear that you are satisfied with our services. Looking forward to working with you in the future.

Wow, Finwell Accounting really blew me away with their top-notch service! The team's so friendly, always greeting with a smile and ready to help. Their work quality is exceptional, never seen such dedication and precision before. They've made running my business a breeze! If you need reliable and high-quality accounting services, this is the place to go, no doubt. Thank you!

About:

Request a quoteServices:

Request a quoteServices:

Request a quoteServices:

Request a quoteServices:

Request a quoteServices:

Request a quoteServices:

Request a quoteServices:

Request a quoteRelated services in Malmesbury

- Malmesbury - Cleaning Services

- Malmesbury - Fences

- Malmesbury - Painters

- Malmesbury - House cleaning services

- Malmesbury - Maid services

- Malmesbury - Palisade fencing

- Malmesbury - Interior painting

- Malmesbury - Painting contractors

- Malmesbury - Security gates

- Malmesbury - Sliding security gate

- Malmesbury - Steel gate

- Malmesbury - Security doors

- Malmesbury - Pressure washing

- Malmesbury - Steam cleaning

- Malmesbury - Upholstery cleaning

- Malmesbury - Deep cleaning services

- Malmesbury - Metal fence

- Malmesbury - House painters

- Malmesbury - Painting services

Frequently asked questions

-

What can a tax consultant help me with?

A tax consultant can help you minimize your tax liability, capitalize on tax deductions and manage your tax situation. They can help you with tax planning, inheritance issues, charitable giving and other complex tax needs.

-

What to look for when choosing a professional tax consultant?

There is a lot to consider when picking a tax consultant. You should carefully consider the different qualifications and certifications available and be sure that your tax consultant is suitably knowledgeable about the issues facing your business. No matter their specific qualifications, you need to know that they have experience and knowledge relevant to your particular field and needs.

-

What documents do I need for tax return?

The following information is needed: IRP5 employee tax certificate, IT3 (b) and (c) certificates from financial institutions in respect of interest, dividends and capital gains, retirement annuity fund or pension fund contribution certificate, Medical Aid certificate of contributions; and travel logbook (related to travel allowances received).

2026 Tax consultant costs

Top Tax consultants in South Africa

- Bellville - Tax consultant

- Camps Bay - Tax consultant

- Cape Town - Tax consultant

- Cape Winelands - Tax consultant

- Century City - Tax consultant

- Claremont - Tax consultant

- Constantia - Tax consultant

- Dana Bay - Tax consultant

- De Waterkant - Tax consultant

- Durbanville - Tax consultant

- Fresnaye - Tax consultant

- Gansbaai - Tax consultant

- Gardens - Tax consultant

- Goodwood - Tax consultant

- Green Point - Tax consultant

- Hermanus - Tax consultant

- Hout Bay - Tax consultant

- Kenilworth - Tax consultant

- Kleinmond - Tax consultant

- Kraaifontein - Tax consultant

- Kuils River - Tax consultant

- Langebaan - Tax consultant

- Muizenberg - Tax consultant

- Observatory - Tax consultant

- Paarl - Tax consultant

- Pinelands - Tax consultant

- Plumstead - Tax consultant

- Rondebosch - Tax consultant

- Saldanha - Tax consultant

- Sandbaai - Tax consultant

- Sea Point - Tax consultant

- Somerset West - Tax consultant

- Stellenbosch - Tax consultant

- Strand - Tax consultant

- Velddrif - Tax consultant

- Vredehoek - Tax consultant

- Wellington - Tax consultant

- West Coast - Tax consultant

- Western Cape - Tax consultant

- Woodstock - Tax consultant

Tax consultant - Featured articles

How to change your accountant: A step-by-step guide

Auto-assessment errors: what to do if your tax is wrong

Received a SARS letter of demand? Practical tips to resolve tax disputes fast

Recent jobs for Tax consultants, Malmesbury

Accounting services for a private company

Individual tax return with pension and annuity

Living Annuity

Individual tax return submission with pension fund considerations

I am at work and available to take calls after 4pm only. Please Whatsapp me. I need to submit my tax return and need assistance please.

Annual financial statements and VAT reconciliation for a Pty Ltd

Good day We are a company that owns a farm. However we do not do farming activities. In , and the company sold shares in the farm and people could get farming share portions for their shares. Currently there are about 25 houses on the farm and a campsite and chalets which we rent out. We supply services to the houses such as water, refuse removal, and maintenance of roads. Our income is higher on paper than actually money coming in as many people are not paying for the services they receive. We would like a quote for our AFS for the period 01 March to 28 Feb . And then we will want the year to be done. Along with the financials we need the fixed asset register to be updated with depreciation journals to be done. We also need the VAT account to be reconciled from the company inception August todate with what is reflected on quickbooks to our VAT's submitted. Please advise what is needed from me. We are looking at about 30 petty cash transactions each month (max). 20 transactions through the bank account and about 25 invoices per month. Thank you Lynda Boshoff

Personal tax return filing for high income

Help with personal tax and filing

Annual financial statement preparation for a private company

I need someone that is registered to provide me with a financial statement once a year. I use Quick books thus will provide a detailed trail balance in the required format, to import and produce a financial statement. I can do it myself, but it has to be signed of by an independent party.

Bookkeeping and tender document assistance for a private company

I need help to fill in tender documents